Monthly Update: Key Events in UK Property & Mortgages - May 2023

As we step into the summer season, we're here with the latest and greatest updates from the UK property and mortgage market. There's been a wealth of activity in May, from innovative loan offerings to rumoured government schemes. Let's delve deeper into the most noteworthy developments of this month.

Green for Go: Nationwide's 0% Green Additional Borrowing Loan

This month saw Nationwide make significant strides with the introduction of their 0% Green Additional Borrowing Loan. Available for existing residential mortgage members, this loan is part of Nationwide's initiative to encourage greener and more sustainable living. The loan is designed to fund eco-friendly home improvements that not only reduce carbon footprints but also potentially decrease energy bills, offering long-term savings for homeowners.

This move by Nationwide is especially timely, given the upcoming Energy Performance Certificate regulations that will pose challenges for many property owners. We're keen to see if this sparks a green trend among other lenders. Could this be an indication of a more relaxed approach from lenders towards borrowing restrictions?

Back to the Future: Skipton's 100% Mortgages

In a rather surprising move, Skipton Building Society announced plans to launch a 100% mortgage, the first since the 2008 financial crisis. Targeting would-be first-time buyers struggling to save for a deposit, this initiative is meant to liberate those who feel trapped in rental cycles.

The details of this pioneering deal are yet to be fully disclosed, but we can anticipate it to have a substantial impact on the market. If proven successful, it might serve as an impetus for other lenders to follow suit. We'll keep a close watch on this development and keep you updated with any further details.

A Helping Hand: The Rumoured Return of Help to Buy

There's been much speculation around a possible government plan to reintroduce the Help to Buy scheme. This strategy could offer much-needed assistance to renters striving to join the property ladder. According to the rumours, this initiative might offer support to buyers seeking both new-build and existing properties.

Although the idea is still in its early stages, we could potentially expect more concrete information by the Chancellor’s Autumn Statement. We'll be keeping a close eye on any official announcements and will promptly relay them to you.

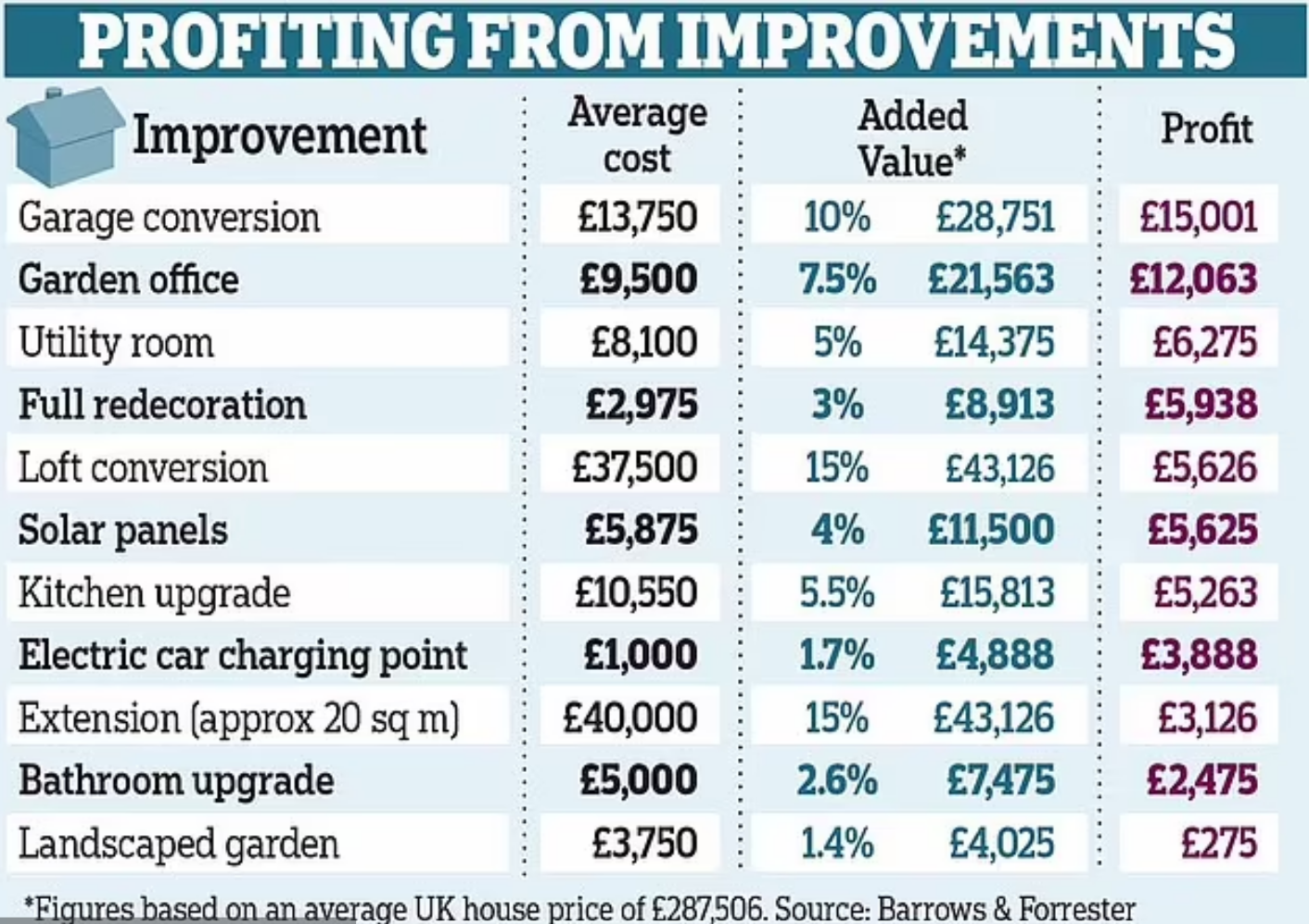

Invest Wisely: Maximising Home Value

For those of you pondering about the best ways to enhance the value of your home, a recent report by This Is Money offers an insightful perspective. The report provides a comprehensive analysis of which home improvements deliver the strongest returns on investment. It's an excellent resource for homeowners seeking to make informed decisions about investing in their properties. For more details, please visit the original article here.

A Silver Lining: The UK Housing Market Rebounds

Despite a 1.3% drop in house prices over the last six months, activity levels in the UK housing market are showing signs of recovery. A combination of falling mortgage rates and a strong labour market seems to be boosting buyer confidence, promising a healthier market scenario.

An increase in sales activity has been observed in the North East, Scotland, and London. Additionally, higher mortgage rates are pushing some landlords to sell their properties, which is contributing to the availability of homes for sale. This could present attractive opportunities for first-time buyers, given that these properties typically come with lower asking prices.

Current State of House Prices

While we've experienced a 1.3% decrease in UK house prices over the past six months, the pace of these price falls has begun to decelerate. This trend suggests a more stable housing market outlook, with the potential for morebalanced property transactions in the months ahead. We're hopeful that this slowdown in price reduction will foster a more favourable climate for both buyers and sellers alike.

Where Sales are Booming: North East, Scotland and London

If you're considering selling your property, you might be interested to know that the North East, Scotland, and London are currently seeing above-average sales activity. These regions are experiencing sales levels that are 10% higher than the rest of the UK. In particular, the affordability of the North East and Scotland, combined with the improved value proposition of London's housing market, is attracting a larger pool of potential buyers.

Higher Mortgage Rates and the Landlord Response

Higher mortgage rates are pushing some landlords to offload their properties, contributing to an increase in the supply of homes for sale. This trend could be a game-changer for first-time buyers, considering that ex-rental homes typically have an asking price that's 25% lower than previously owned homes. This affordability factor, coupled with the rising number of available properties, makes it an opportune time for those looking to secure their first home.

Plan Your Sale Strategically

If you're planning to sell your home this year, it's important to note that while sales are indeed being agreed upon, you'll need to set a realistic asking price to effectively attract buyer interest. It's crucial to approach the market strategically, taking into consideration factors such as current market trends and buyer preferences. At Willow Private Finance, we're always here to offer guidance and ensure you make an informed decision.

Predictions for the Second Half of 2023

Looking ahead, while demand has taken a slight dip due to the rise in mortgage rates, the impact on house prices has been tempered thanks to lending regulations. However, we do expect a continued gradual decrease in prices throughout 2023. The potential for further interest rate rises, which would result in higher mortgage rates, may dampen demand and activity in the second half of 2023.

This could exert downward pressure on house prices, reducing buying power and demand for homes. Moreover, the number of home sales taking place in 2023 is projected to be 20% lower than last year. These factors combined suggest that we might see a cooler property market towards the end of the year.

Navigating the rest of 2023 will require a careful and informed approach, and our team at Willow Private Finance is ready to guide you through these shifting currents. We appreciate your trust in our services and are committed to helping you make the best decisions possible. Please do not hesitate to reach out to us with any questions or for personalised advice.