Navigating Article 4, LTC vs LTV metrics, and smoothing the exit to specialist term debt in a high-compliance market.

As we move through the first quarter of 2026, the UK property market is witnessing a profound shift in how professional developers approach high-yield residential assets. With traditional "buy-to-flip" margins compressed by high entry costs and 2026’s revised Stamp Duty thresholds, the smart money has pivoted.

The "Bridge-to-HMO" strategy has emerged as the premier vehicle for capital growth, allowing investors to purchase undervalued residential stock, force appreciation through intensive refurbishment, and exit onto high-leverage term debt.

However, the 2026 landscape is not the permissive environment of years past.

The gap between a successful conversion and a stranded asset has widened, primarily due to the tightening of lender "Exit Underwriting." According to latest sentiment reports from

Knight Frank, developers are increasingly focusing on Gross Development Value (GDV) as the primary metric for project viability, but achieving that GDV requires a surgical understanding of 2026’s specific financial and regulatory friction points.

Financing the Conversion: LTC vs. LTV Metrics

In the 2026 lending environment, the distinction between Loan-to-Cost (LTC) and Loan-to-Value (LTV) has never been more critical. While traditional high-street lenders remain tethered to conservative LTV caps—often failing to account for the rapid value uplift of an HMO conversion—specialist bridging lenders have evolved.

We are currently seeing a surge in "Stretch Senior" bridging debt, where lenders are willing to advance up to 85% or even 90% of the Purchase Price (LTC) plus 100% of the refurbishment costs. The "Strategic Analysis" here is simple: by maximizing LTC, developers can preserve their own "Dry Powder" for simultaneous acquisitions. However, the trade-off in 2026 is a more rigorous "Cost-to-Complete" audit. Lenders now demand a 15% contingency fund to be proven upfront, a direct response to the lingering volatility in construction material costs reported by

HM Land Registry data.

The 2026 winner is the developer who can prove that their LTC structure doesn't just fund the build, but protects the GDV. Underwriters are looking for "Value-Add Transparency"—a clear roadmap of how a £400,000 purchase becomes a £750,000 HMO asset, backed by comparable evidence that reflects the 2026 Renters' Rights Act compliance costs.

Navigating Article 4 Planning Restrictions in 2026

Article 4 directions—the local authority tool used to remove permitted development rights for HMOs—have expanded significantly in 2026. What was once a concern for a few "hot" university towns is now a widespread urban reality. Navigating this planning friction is where most DIY developers see their GDV evaporate.

From a finance perspective, an Article 4 area transforms the property from a "Residential C3" asset to a "Sui Generis" or "C4" specialist asset. In 2026, bridging lenders will not lend on an "HMO Exit" basis if the planning trajectory is uncertain. The "Hidden Friction Point" is the

Planning Lag. Many developers assume they can secure a bridge, start the work, and get the Certificate of Lawfulness later. In 2026, lenders are blocking drawdowns until the planning risk is fully mitigated.

To maximize GDV, developers must utilize "Planning-Enhanced Bridging." This involves securing a facility that recognizes the "Subject to Planning" value uplift. By involving a specialist like Willow early, we ensure your bridge is structured to account for the specific planning constraints of 2026, preventing a situation where you are forced to exit at a standard residential valuation because your HMO licensing was mishandled.

The "Standard AST" vs. "Room-by-Room" Valuation Gap

One of the most persistent challenges in 2026 is the divergence between "Bricks and Mortar" valuations and "Investment" valuations. A six-bed HMO might have a rebuild cost of £300,000 but an investment value of £600,000 based on its yield. In 2026, the "Valuation Gap" is being policed more heavily by RICS surveyors.

Under the 2026 Renters' Rights Act, surveyors are increasingly applying "Yield Discounts" to properties where the room sizes are borderline or where the communal space doesn't meet the new "Enhanced Decent Homes" criteria.

If a surveyor values your HMO on a "standard family home" basis rather than a "yield-bearing" basis, your LTV on the exit will collapse, leaving your capital trapped in the deal.

The strategy for 2026 is

"Yield Defense." This means designing the conversion not just for the tenant, but for the surveyor. This includes over-specifying communal areas and ensuring every room exceeds the minimum 2026 size mandates by at least 10%. A property that is "unquestionably an HMO" in the eyes of a surveyor attracts the investment-based valuation required to recycle 100% of your initial capital.

Smoothing the Exit: Bridging to Term with Specialist Lenders

The "Bridge-to-HMO" strategy is only as good as its exit. In 2026, the bridge exit is no longer a formality. With the Bank of England's current stance on base rates and the 2026 shift to mandatory periodic tenancies, term lenders are far more selective. They are looking for "Stabilized Yields."

A common mistake in 2026 is attempting to exit the bridge the moment the last carpet is laid. Specialist term lenders now frequently require "Three Months' Proven Income" or a "Management Audit" before they will commit to a sub-4% margin. This creates a liquidity gap for developers who need to move on to their next project immediately.

The 2026 solution is the

"Retained Interest Exit."

By structuring the bridge to include a 3-6 month "stabilization window" where interest is retained rather than serviced, developers can provide the term lender with the "Seasoned Income" they require. This ensures a smooth transition to a 5 or 10-year specialist BTL product, locking in the forced appreciation and protecting the portfolio from the volatility of 2026’s short-term markets.

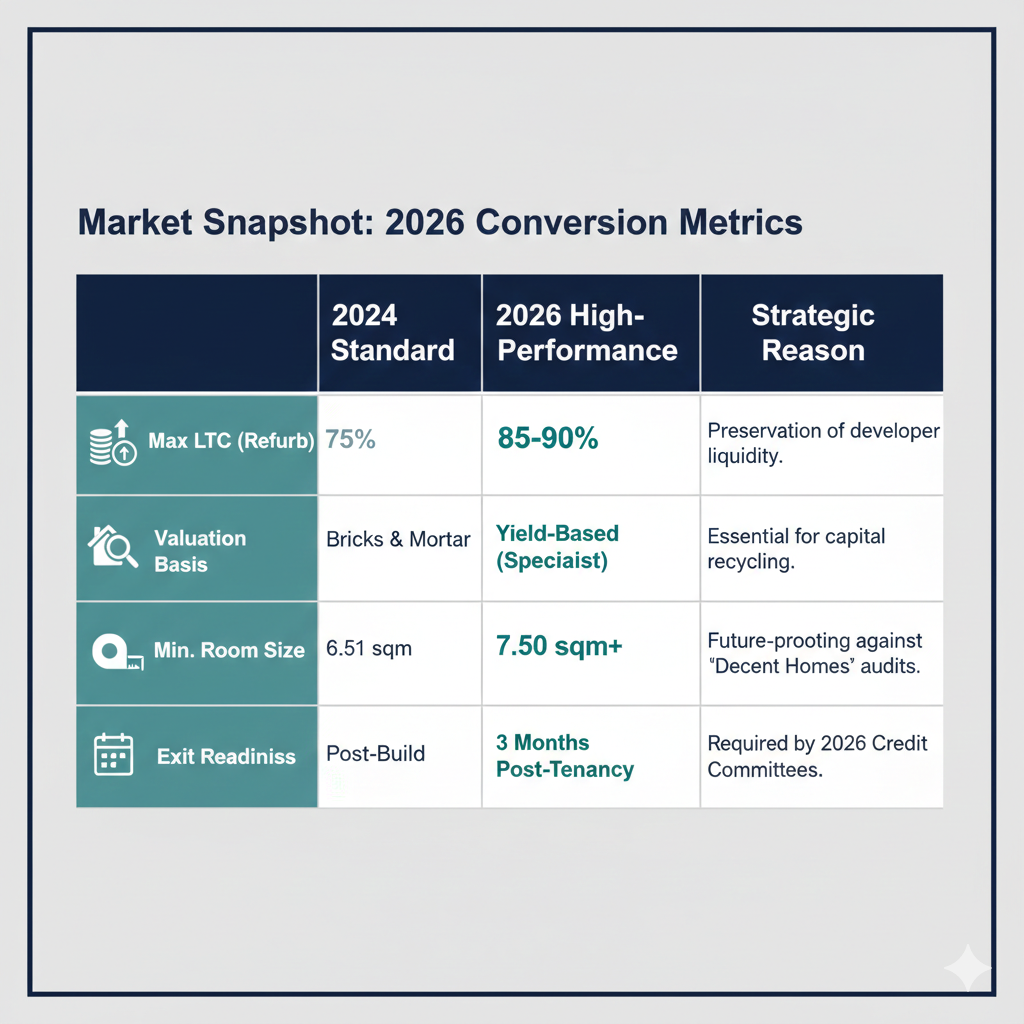

Market Snapshot: 2026 Conversion Metrics

Where Most Borrowers Inadvertently Go Wrong in 2026

The "Hidden Friction Point" for Bridge-to-HMO deals in 2026 is

"Technical Under-Specification."

Many developers use refurb specs that were acceptable in 2023. However, 2026 underwriters are now performing "Desktop Compliance Audits" on the build specs before the first bridge drawdown. If your spec doesn't include the 2026 mandatory fire-suppression systems or smart-metering for communal utilities, the lender will "down-value" the exit GDV at the start of the project.

Strategic Insight: You cannot "retro-fit" an exit strategy. In 2026, your term lender's requirements must dictate your bridge lender's build-spec. If there is a mismatch between the build and the exit criteria, you will find yourself stuck on a 0.95% monthly bridge rate with no way out.

At this stage, most successful borrowers involve a specialist like Willow Private Finance to sense-check the case before it reaches another credit committee.

Frequently Asked Questions

What is the difference between LTC and LTV in a 2026 bridging context?

Loan-to-Cost (LTC) focuses on the actual capital you are deploying—the purchase price plus the refurbishment costs. In 2026, specialist lenders are more focused on LTC as it represents the "real" risk. Loan-to-Value (LTV) is the ratio against the property's current or future value. To maximize GDV, you want a lender who offers high LTC (up to 90%), allowing you to keep your capital liquid. However, this high leverage requires a more robust "Cost-to-Complete" audit from the lender's monitoring surveyor.

How does Article 4 impact my ability to get bridging finance in 2026?

Article 4 is a significant "Red Flag" for non-specialist lenders. In 2026, if you are buying in an Article 4 area without existing C4 use, you must prove a "High Probability of Consent." Most bridging lenders will now only lend at standard residential LTVs (around 60-65%) unless you have a "Certificate of Lawfulness" or a "Pre-App" that supports the HMO conversion. Navigating this requires a bridge that is structured "Subject to Planning" uplift to avoid a capital shortfall at the point of purchase.

Why is the "Room-by-Room" valuation so important for my exit strategy?

In 2026, the only way to recycle significant capital is through a "Yield-Based" or "Investment" valuation. If a surveyor values your HMO on a "Bricks and Mortar" basis (treating it as a single family home), the valuation will likely be 20-30% lower. To secure the higher "Room-by-Room" valuation, your property must meet specific 2026 criteria: non-shared facilities where possible, high-spec communal areas, and clear evidence of "Sui Generis" or "C4" planning status.

Can I exit a bridge onto a term mortgage immediately after refurbishment?

While possible in 2024, the 2026 market has become more cautious. Many Tier 1 specialist lenders now require "Income Seasoning"—usually 3 months of proven rent—before they will offer their best rates. This is a direct result of the 2026 Renters' Rights Act, as lenders want to see how the "Periodic Tenancy" structure is performing before committing to long-term debt. We solve this by structuring your bridge with "Retained Interest" to cover this 3-month gap.

What are the mandatory fire-safety requirements for HMOs in 2026?

The 2026 standards have moved beyond simple smoke alarms. For any new conversion seeking specialist finance, underwriters now expect Grade A LD1 fire systems and, in many jurisdictions, "Domestic Sprinkler Systems" for properties over three stories. If these are not in your build spec, your exit lender may "Down-Rate" the property's safety score, leading to higher insurance premiums and lower DSCR (Debt Service Coverage Ratio) results.

What is a "Retained Interest Exit" and why is it used in 2026?

A Retained Interest Exit is a strategy where the last 3-6 months of bridging interest are "rolled up" or held back by the lender. This allows the developer to finish the build and tenant the property without having to "service" the monthly debt from their own pocket. It provides the "Breathing Room" needed to collect the 3 months of rent receipts required by 2026 term lenders, ensuring a smooth transition to long-term finance without a liquidity crunch.

How Willow Can Help

At Willow Private Finance, we don't just secure bridging; we architect the entire lifecycle of your 2026 HMO project. We understand that a "Bridge-to-HMO" deal is a three-dimensional puzzle involving planning law, construction risk, and long-term yield analysis. We work with you at the "Pre-Offer" stage to ensure that the purchase price, build cost, and projected GDV are all aligned with the appetites of the 2026 specialist exit market.

Our advantage lies in our "Whole-of-Market Navigation." We have access to "Bridge-to-Term" hybrid products that provide a pre-approved exit route from day one. This eliminates the "Interest Rate Anxiety" of 2026, as you know exactly what your long-term debt will cost before you even pick up a sledgehammer. We solve the "Friction Point" of 2026 by ensuring your technical specifications meet the rigorous standards of both the bridge and term underwriters, ensuring a seamless capital recycling process.

Whether you are navigating Article 4 in a new jurisdiction or looking to maximize LTC on a multi-million pound conversion, our team provides the technical authority and execution speed required in today's market. We invite you to contact us for a project-specific "GDV Stress Test" to ensure your next conversion is built on a foundation of solid finance.

Important Notice

This article is provided for general information purposes only and does not constitute personal financial or mortgage advice. Mortgage suitability, affordability assessments, lender criteria, documentation requirements, and product availability depend on individual circumstances and may change at any time. Remortgaging decisions should take into account not only interest rates, but also regulatory requirements, income verification standards, and the risk of changes to personal or financial circumstances. You should always seek tailored, regulated advice before entering into, changing, or redeeming a mortgage. Willow Private Finance Ltd is authorised and regulated by the Financial Conduct Authority (FCA No. 588422). Registered in England and Wales.