Decoding Last Weeks IMF Report: The Future of UK Property and Mortgage Interest Rates in a Post-Pandemic World

The Future of UK Property and Mortgage Interest Rates: What to Expect

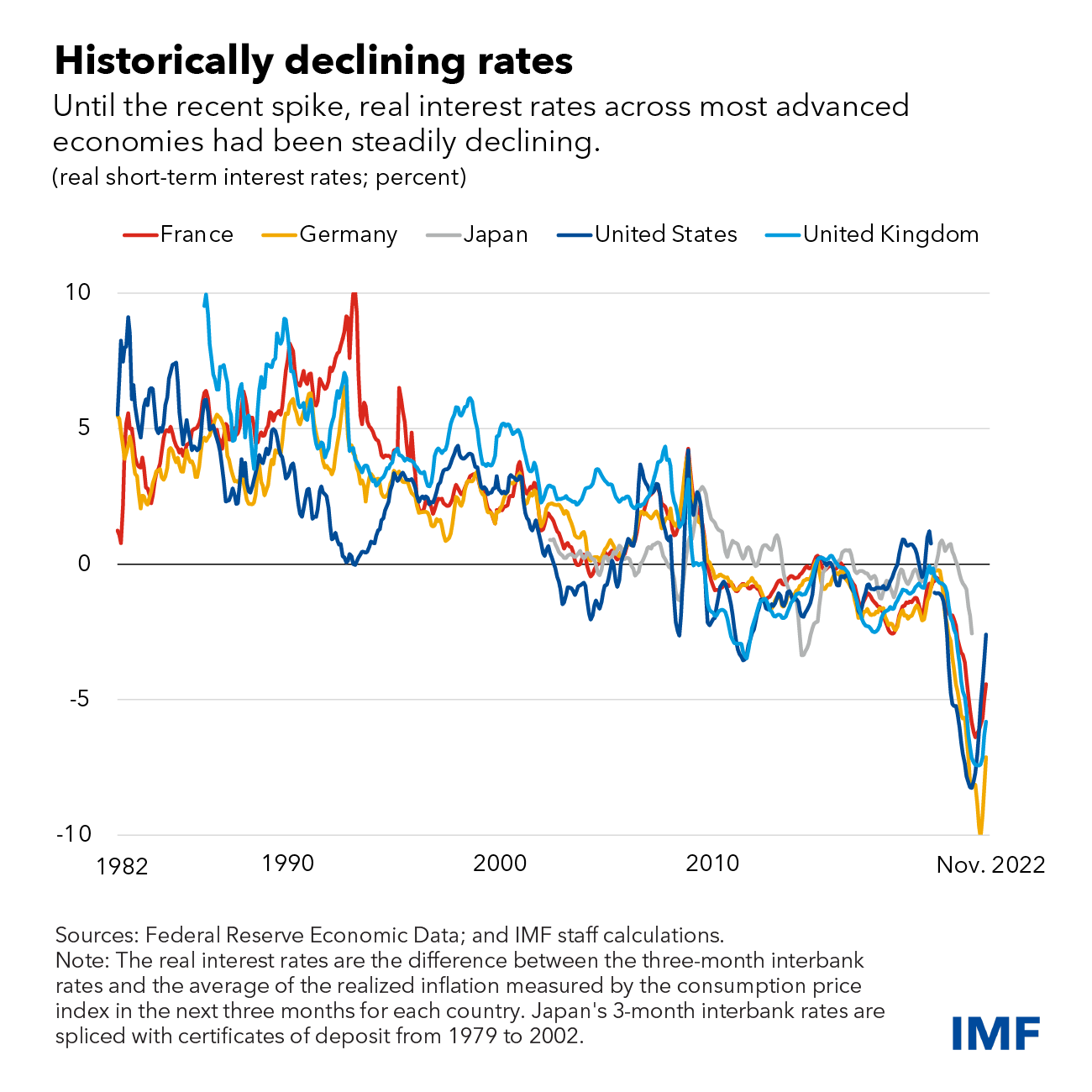

In recent times, real interest rates have risen due to tightened monetary policy in response to higher inflation. This has raised concerns among property buyers and investors regarding the implications of these interest rate changes on the UK property market and mortgage interest rates. In this blog, we will explore the connection between real interest rates, central bank policies, and mortgage interest rates in the UK, and discuss the possible impact of these changes on the UK property market.

The Connection between Real Interest Rates and Mortgage Interest Rates

Real interest rates represent the cost of borrowing money, taking into account the rate of inflation. When real interest rates rise, it becomes more expensive for banks and other financial institutions to borrow money, which in turn affects the interest rates they charge their customers, including mortgage interest rates.

The Bank of England, the UK's central bank, sets the base interest rate, which influences the cost of borrowing for banks and financial institutions. When the Bank of England raises the base interest rate, it usually leads to higher mortgage interest rates as lenders pass on the increased costs to borrowers. Conversely, when the base interest rate is lowered, mortgage interest rates tend to decrease as well.

In the current economic climate, higher inflation has prompted central banks, including the Bank of England, to tighten monetary policy, leading to a rise in real interest rates. As a result, there are concerns that mortgage interest rates in the UK may also increase, making it more expensive for homebuyers and property investors to secure financing.

Factors Influencing the Future of Real Interest Rates

The natural rate of interest is a key factor in determining the level of real interest rates. It represents the equilibrium interest rate that would keep inflation at the target rate and maintain the economy at full employment, neither expansionary nor contractionary. Several factors influence the natural rate of interest, including global forces, demographic changes, and total factor productivity growth.

Global forces, such as international trade and investment, can impact the natural rate of interest as they affect the supply and demand for capital. Demographic changes, such as aging populations and declining fertility rates, can also influence the natural rate as they affect the balance between savings and investment. Finally, total factor productivity growth, which measures the efficiency with which inputs are used to produce output in the economy, can impact the natural rate as it affects the returns on investment.

Recent analyses suggest that these factors are unlikely to change significantly in the future, indicating that natural rates in advanced economies, like the UK, will remain low. As emerging market economies adopt more advanced technology and face aging populations, their natural rates are projected to decline towards those of advanced economies over the long term.

Implications for the UK Property Market

The expectation of low natural rates in the future has several implications for the UK property market. Firstly, low natural rates may help support property prices, as the cost of borrowing remains relatively low, making it more affordable for homebuyers and investors to purchase properties. Low mortgage interest rates can also stimulate demand for housing, as buyers are encouraged to enter the market, further supporting property prices.

However, it is essential to note that the UK property market is influenced by a range of factors, including supply and demand dynamics, government policies, and economic growth. While low natural rates may help support property prices, other factors, such as a slowdown in economic growth or tighter government regulations, could put downward pressure on the market.

For mortgage interest rates, low natural rates may result in lower borrowing costs for homebuyers and property investors in the UK. This could encourage more people to enter the property market, boosting demand for housing and potentially leading to an increase in property prices. However, as mentioned earlier, the actual impact on mortgage interest rates will depend on the actions of the Bank of England and the wider economic environment.

It is also important to consider the potential risks associated with low mortgage interest rates. While lower borrowing costs can make property purchases more affordable, they may also encourage excessive borrowing and lead to higher levels of household debt. This could create vulnerabilities in the financial system and pose risks to the stability of the UK property market.

Alternative Scenarios and Their Impact on UK Property and Mortgage Interest Rates

While the current analysis suggests that natural rates are likely to remain low in the future, it is essential to consider alternative scenarios that could impact the natural rate and, consequently, the UK property market and mortgage interest rates.

- Persistently higher government debt: If the government finds it difficult to withdraw support measures implemented during the pandemic, public debt may continue to rise. This could lead to an erosion of convenience yields – the premium paid by investors for holding scarce, safe, and liquid government debt – resulting in higher natural rates. In this scenario, mortgage interest rates in the UK may also increase, potentially affecting property prices and demand for housing.

- Financing of climate policies: The transition to a cleaner economy could impact global natural rates depending on how climate policies are financed. If the transition is budget-neutral, higher energy prices resulting from taxes and regulations may lower the marginal productivity of capital, pushing global natural rates lower in the medium term. However, deficit-financed public investment in green infrastructure and subsidies could offset and even reverse this effect, potentially leading to higher natural rates and mortgage interest rates.

- Deglobalization: If deglobalization forces intensify, leading to trade and financial fragmentation, the natural rate may increase in advanced economies like the UK and decrease in emerging market economies. In this scenario, mortgage interest rates in the UK may also rise, with potential implications for the property market.

These alternative scenarios could individually have limited effects on the natural rate, but a combination of these factors, particularly the first and third scenarios, could have a significant impact on the UK property market and mortgage interest rates in the long run.

In summary, the recent increase in real interest rates is likely to be temporary, and when inflation is brought back under control, central banks in advanced economies, including the Bank of England, are expected to ease monetary policy, bringing real interest rates back towards pre-pandemic levels. This suggests that mortgage interest rates in the UK may also return to pre-pandemic levels, supporting property prices and demand for housing.

At Willow Private Finance, we are committed to helping our clients navigate the complexities of the UK property market and secure the best mortgage rates available. Our team of experts is available to provide personalised advice and guidance on property financing, tailored to your individual needs and circumstances.