The Ultimate Guide to Remortgaging: Understanding the Costs and Finding the Best Deal

Are you looking to re-mortgage and reduce your payments or improve your terms?

Look no further than Willow Private Finance!

Our team of experts can secure the best mortgage rates for your unique circumstances, whether you're based in the UK or overseas.

We specialize in arranging mortgages for the UK property market, but our client base is becoming increasingly global. We can also provide bespoke solutions for a wide range of unusual circumstances such as uncommon property types or individuals with complicated income streams and asset structures.

Trust Willow Private Finance to guide you through the re-mortgaging process and secure the best deal for you.

Get A Mortgage Quote Today

Contact Us

Maximizing Savings and Finding the Best Deal: A Comprehensive Guide to Remortgaging Your Home

What is Remortgaging?

Remortgaging is the process of switching your mortgage to a new lender or a new deal with your existing lender. This can potentially save you money on your monthly mortgage payments and the overall cost of your loan by securing a lower interest rate. Its also important to understand The Pros and Cons of Remortgaging Your Home

Reasons to Consider Remortgaging Your Home

There are several reasons why you might consider remortgaging your home:

- To secure a lower interest rate: One of the main reasons people consider remortgaging is to secure a lower interest rate on their mortgage. A lower interest rate means lower monthly payments, which can save you money in the long run.

- To change mortgage providers: If you're unhappy with your current mortgage provider or you've found a better deal with another lender, remortgaging can be a good option.

- To release equity: If you've built up equity in your home, you may be able to remortgage to release some of this equity and use it for other purposes, such as home improvements or debt consolidation.

- To change the type of mortgage: If your circumstances have changed, you may want to switch to a different type of mortgage, such as a fixed-rate mortgage if you're looking for stability or an adjustable-rate mortgage if you expect interest rates to go down.

When is the Best Time to Remortgage?

The best time to remortgage will depend on your individual circumstances and the mortgage market. Here are a few factors to consider:

- Interest rates: If interest rates are low, it may be a good time to remortgage to secure a lower rate. However, you should also consider the costs of remortgaging and make sure that the savings from a lower interest rate outweigh those costs.

- The end of a fixed-rate period: If you have a fixed-rate mortgage, it's a good idea to start shopping around for a new deal a few months before the fixed-rate period ends. This will give you time to compare rates and find the best deal.

- Your credit score: If you've improved your credit score since taking out your current mortgage, you may be able to secure a better deal by remortgaging.

- Your current mortgage deal: If you're on a high standard variable rate (SVR) or a deal with high fees, it may be worth considering remortgaging to a lower rate or a deal with lower fees.

Costs of Remortgaging

There are several costs associated with remortgaging that you should be aware of:

- Arrangement or product fee: This is a fee charged by the lender for providing the new mortgage. It can range from a few hundred pounds to several thousand pounds.

- Early repayment charge (ERC): If you switch to a new lender, you may have to pay an ERC to your current lender for ending your mortgage deal early. This fee can be several thousand pounds, depending on the terms of your existing mortgage.

- Valuation fee: Most lenders will require a valuation of your property before approving a new mortgage. The cost of this fee will depend on the value of your property.

- Legal fees: You will need to hire a solicitor to handle the legal work associated with remortgaging, such as transferring the mortgage to a new lender. The cost of legal fees will depend on the complexity of the case.

- Broker fees: If you use a mortgage broker to help you find a new deal, you may have to pay a fee for their services. The cost of broker fees will depend on the broker and the complexity of your case.

- Redeeming your current mortgage: If you're switching to a new lender, you'll need to pay off your existing mortgage. This is known as redeeming your mortgage. You'll need to pay any outstanding balance and any early repayment charges, if applicable.

It's important to carefully consider all of these costs when deciding whether to remortgage. Make sure to compare the total cost of each option, including any arrangement or product fees and early repayment charges, to ensure that you're getting a good deal.

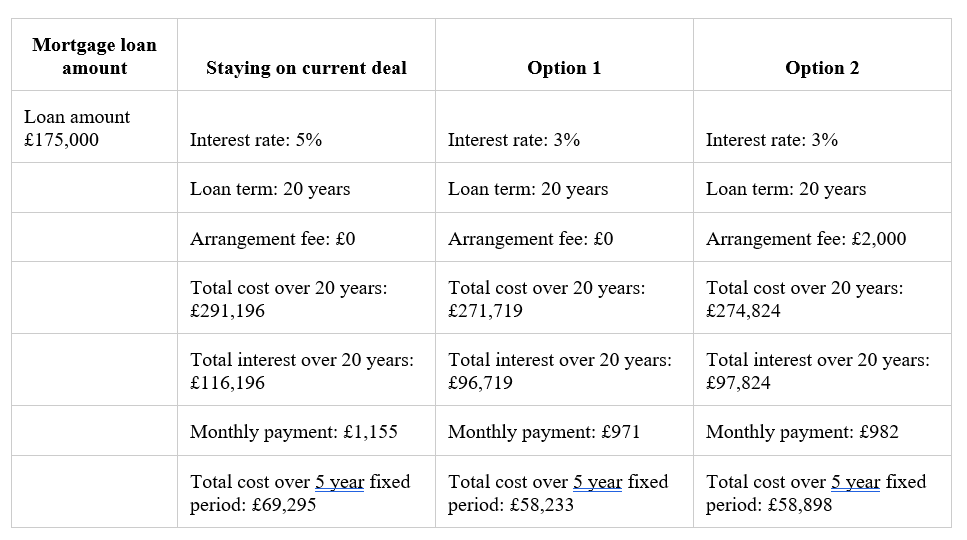

To help you understand the costs of remortgaging, here is an example using a table:

In this example, both option 1 and option 2 save you money compared to staying on your current mortgage, but option 1 saves you more. However, you should consider all of the costs, not just the interest rate, when deciding which option is best for you.

How to Remortgage

If you're considering remortgaging your home, here are the steps you should follow:

- Shop around: Compare rates and deals from a variety of lenders to find the best option for you. You can do this on your own or use a mortgage broker to help you find the best deal.

- Check your credit score: Lenders will check your credit score before approving a new mortgage. If your credit score is low, you may not be able to secure a good deal.

- Gather all necessary documents: Lenders will require proof of income, bank statements, and other documents before approving a new mortgage. Make sure you have all of the necessary documents ready.

- Get a valuation: Most lenders will require a valuation of your property before approving a new mortgage.

- Choose a solicitor: You will need to hire a solicitor to handle the legal work associated with remortgaging.

- Apply for the mortgage: Once you've found a lender and a deal that you like, you can apply for the mortgage. Make sure to read the terms and conditions carefully and ask any questions you may have before signing the contract.

- Pay off your current mortgage: If you're switching to a new lender, you'll need to pay off your existing mortgage. This is known as redeeming your mortgage.

- Transfer the mortgage to the new lender: Your solicitor will handle the transfer of the mortgage to the new lender.

Conclusion

Remortgaging can be a good way to save money on your mortgage and potentially lower your monthly payments. However, it's important to carefully consider the costs and make sure that the savings outweigh those costs. Shop around and compare rates from multiple lenders to find the best deal for you.

How Can Willow Private Finance Help?

Willow Private Finance is a specialist mortgage broker that is well-placed to support a remortgage application. As a broker, Willow Private Finance has access to 100's of lenders, including private banks, high street lenders, and alternative and niche lenders. This means that Willow Private Finance can help you access a wide range of offers and find the most competitive rates on the market.

In addition, Willow Private Finance has expertise in negotiating with lenders on behalf of clients. The team at Willow Private Finance can tailor a refinance package to your specific needs and negotiate with lenders to get the best rates and terms available. This can be particularly helpful if you have a complex financial situation or a high loan-to-value (LTV) ratio, as Willow Private Finance can access lenders that you may not be able to approach on your own.

Furthermore, Willow Private Finance can provide expert advice and guidance throughout the process of remortgaging. The team at Willow Private Finance can help you understand your options, assess the long-term impact of remortgaging, and navigate the fees and other potential obstacles that may arise. This can make the process of remortgaging smoother and less stressful for you.

In short, Willow Private Finance is a specialist mortgage broker that is well-placed to support a remortgage application. With access to a wide range of lenders, expertise in negotiation, and a commitment to providing expert guidance, Willow Private Finance can help you find the best deal on a remortgage and make the process as smooth and stress-free as possible.