Maximize Your Property Development Potential with Development Finance

Unlock the Benefits of Larger-Scale Projects, Streamlined Cash Flow, and Higher Investment Returns

Property developers often use development finance as a way to fund new-build developments or property renovations. This type of finance offers multiple benefits that make it appealing to developers.

One of the main advantages of development finance is that it allows developers to take on larger-scale projects with only a small deposit required. For example, a developer may be able to secure 70% of the cost of the land and 100% of the value of the build. This means that developers don't need to use their own capital to raise the deposit and can instead use it to diversify their investments and reduce their risk.

Another advantage of development finance is that it allows for more streamlined cash flow management. Since developers only need to put down a small deposit, they don't need to tie up all of their savings in one property development. This reduces their financial risk and allows them to invest in other properties.

Furthermore, development finance can lead to higher investment returns. Because developers are only required to put down a small deposit, they are able to invest less capital initially. This means that their return on investment will be higher when they sell the finished properties.

For example, if a developer is building twelve residential properties and the land costs £1 million, they might be able to borrow 90% of the total development costs. This means that they only need to put down a deposit of £100,000, rather than the full £1.8 million cost of construction. When the properties are sold, the developer will be able to pay off the loan and keep the remaining profits as their return on investment.

Overall, development finance offers property developers the ability to take on larger projects, manage their cash flow more effectively, and increase their investment returns. This makes it a popular financing option for many property developers.

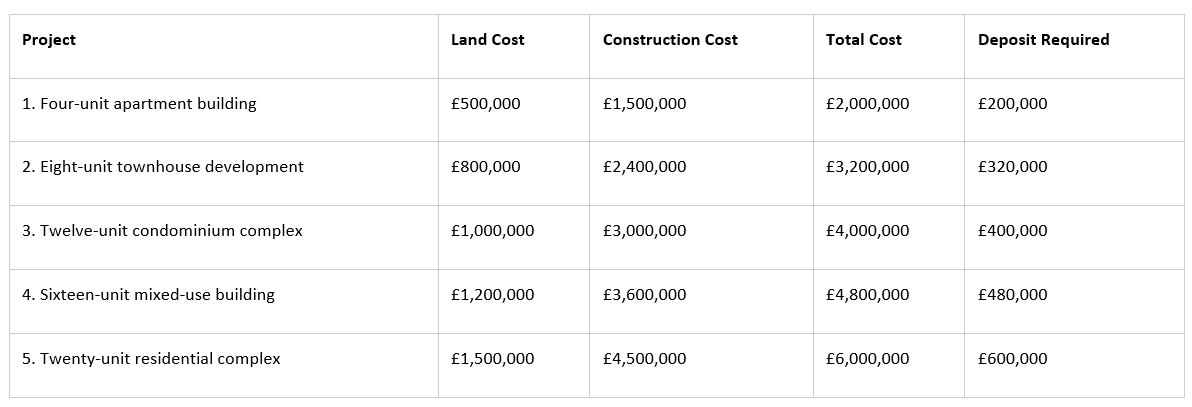

Here are some more examples of property development projects and how much the developer would need to put down as a deposit if they were using development finance:

In each of these examples, the developer is able to borrow 90% of the total development costs, which means they only need to put down a 10% deposit. This allows them to use their capital more effectively and reduce their financial risk.

Who Are Willow Private Finance?

Willow Private Finance is a specialist mortgage brokerage that offers professional financial advice and assistance to clients seeking to secure a mortgage or refinance their existing mortgage. The company is dedicated to providing its clients with personalized and tailor-made solutions to meet their specific financial needs and goals.

With a team of highly qualified and experienced mortgage advisors, Willow Private Finance is able to offer expert advice and guidance on a wide range of mortgage products and options, including first-time buyer mortgages, buy-to-let mortgages, Commercial mortgages, Bridging finance, Lombard lending, and Development finance. The company also offers a range of services to help clients navigate the complex and often confusing process of securing a mortgage, including assistance with mortgage application and documentation, as well as ongoing support throughout the mortgage process.

In addition to its mortgage brokerage services, Willow Private Finance also offers a range of other financial services, including protection insurance and equity release.. The company's goal is to provide its clients with a comprehensive and holistic approach to finance and management, helping them to achieve their financial goals and secure their financial future.

Other articles that may be of interest -

Unlock the Potential of Your Property Development Project with These 3 Finance Options: Purchase, Project, and Flexible Finance – Click Here

4 Factors Lenders Consider When Evaluating Development Finance Application – Click Here

5 Common Challenges to Property Development Financing and How to Overcome Them - Click Here

Understanding Development Finance: A Guide to Funding Property Development Projects- Click Here

Maximize Your Property Development Potential with Development Finance – Click Here