Navigating the transition to periodic tenancies and the evolution of specialist Buy-to-Let underwriting in a post-Section 21 landscape.

The UK private rented sector (PRS) has officially entered its most significant transformative phase in decades. As of May 1st, 2026, the implementation of the Renters’ Rights Act has fundamentally altered the structural relationship between specialist landlords and their tenants.

For those managing Houses in Multiple Occupation (HMOs), the stakes are uniquely high. The total abolition of Section 21 "no-fault" evictions and the mandatory shift to rolling periodic tenancies have moved beyond legislative debate into the cold reality of credit committee scrutiny.

For the professional landlord, the challenge isn’t just operational; it is financial. Lenders have spent the last quarter recalibrating their risk models to account for what they perceive as a "liquidity lag" in repossessions and a potential increase in void volatility.

According to recent data from

Savills, the demand for high-quality HMO stock remains robust, yet the friction of management has increased. Understanding how to present a portfolio to a specialist underwriter in this new era is the difference between securing competitive leverage and facing a restrictive "covenant crunch."

Stress-Testing for Periodic Tenancy Voids

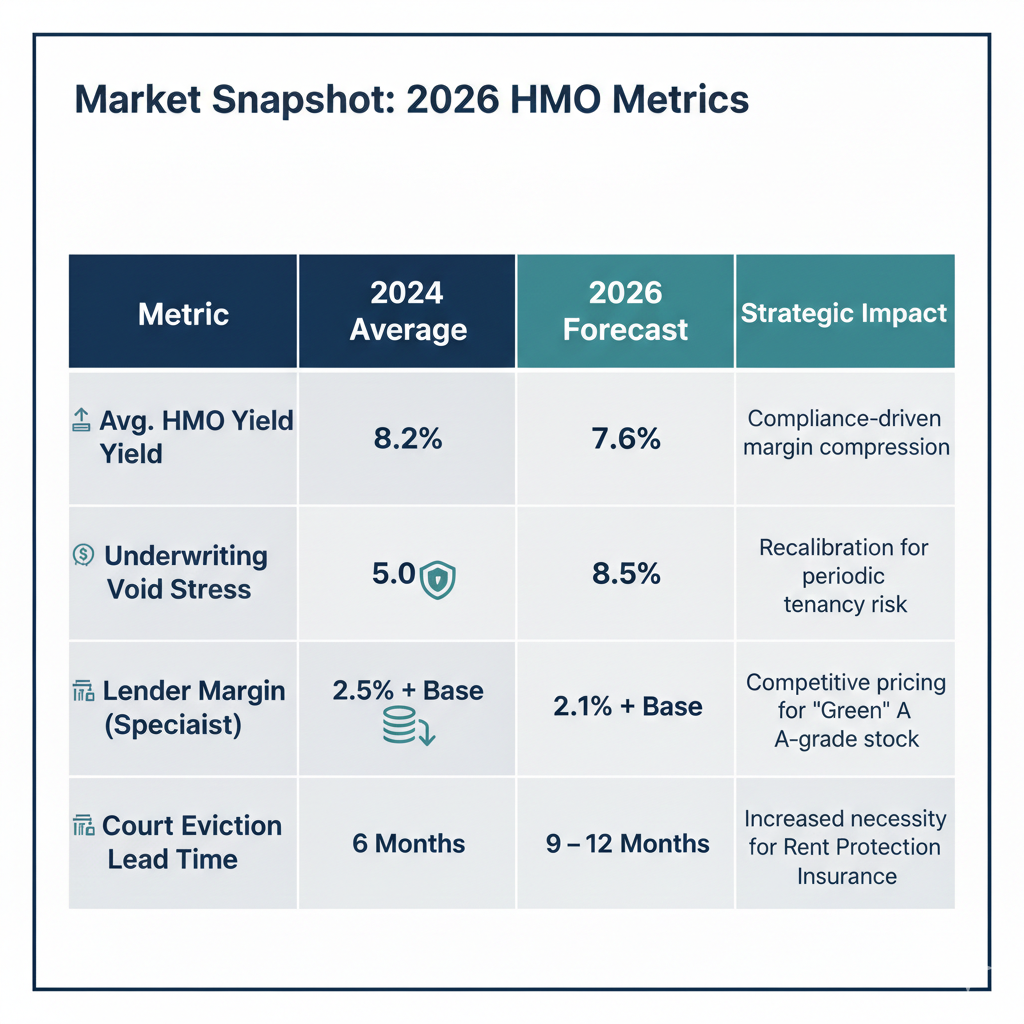

The death of the Fixed Term Tenancy is the headline change of 2026. Previously, a 12-month AST provided a predictable income floor that underwriters loved. Now, with all tenants on periodic terms from day one, the "churn risk" has theoretically spiked. In response, we are seeing specialist lenders—particularly those funded by institutional capital—increasing their stressed void assumptions.

Where an underwriter might have previously applied a 5% or 7.5% void allowance, some are now testing at 10% for HMOs in non-student urban hubs. The "Hidden Friction Point" here is the

Cumulative Void Shock. If a six-bed HMO sees three tenants give notice simultaneously under the new flexible notice periods, the debt service coverage ratio (DSCR) can look precarious to a conservative lender. To mitigate this, professional borrowers must demonstrate a robust "Tenant Sticky Factor"—using data-led evidence of historical stay-lengths and hyper-efficient re-letting processes to prove that "periodic" does not mean "transient."

Lender Appetite for Multi-Unit Blocks in 2026

While individual HMOs face scrutiny, Multi-Unit Freehold Blocks (MUFBs) are becoming the "defensive play" of 2026.

The

Financial Times has noted a distinct rotation of capital toward assets where the landlord retains greater structural control. From an underwriting perspective, MUFBs are viewed as having diversified risk; the failure of one tenancy agreement under the new Act is less catastrophic than a total "property-level" void.

However, the 2026 market has seen a tightening of "concentration limits."

Lenders are increasingly wary of becoming over-exposed to a single postcode where local authority licensing—combined with the new national standards—creates a "compliance ceiling."

We are seeing a divergence in the market: Tier 1 specialist banks are hungry for high-yielding MUFBs but are demanding "enhanced management bios." They aren't just lending on the bricks; they are lending on your ability to navigate the 2026 ombudsman requirements and the digital "Property Portal" mandates.

Yield Compression: Factoring in New Compliance Costs

It is an objective truth that the 2026 Renters’ Rights Act has introduced a "compliance tax" on yields. Between the Decent Homes Standard now applying to the PRS and the mandatory participation in the new redress schemes, the cost per unit has risen.

Knight Frank reports that gross yields in the HMO sector have had to adjust by roughly 40-60 basis points to maintain the same net position seen in 2024.

Underwriters are now performing "Net Yield Sensitivity" audits. They no longer look at the gross rent and a standard 20% expense ratio. They are looking for line-item transparency on compliance spending. If your portfolio hasn't been audited for the new 2026 EPC "C" expectations or the updated fire safety protocols for HMOs, lenders will simply "haircut" your valuation. This yield compression means that "liquidity optimization"—finding ways to release equity without triggering a full revaluation at a higher cap rate—is the dominant strategy for 2026.

Strategic Retention: Avoiding Section 21 Friction

The removal of Section 21 has turned "possession risk" into a primary underwriting metric. Lenders are terrified of "trapped capital"—properties where a non-performing tenant cannot be evicted due to backlogs in the reformed court system.

The Telegraph has highlighted that the "Grounds for Possession" under the new Section 8 framework are more robust but require higher standards of evidence.

For a borrower seeking a remortgage in 2026, the "Credit Narrative" must include a proactive tenant management strategy. Lenders want to see that you aren't just a rent collector, but a sophisticated operator with a legal "war chest" and a history of mediated resolutions. The goal is to prove that your portfolio is "friction-less." If a lender senses that your management style is reactive, they will price in the "eviction lag," leading to higher margins and lower LTVs.

Market Snapshot: 2026 HMO Metrics

In the current climate, many landlords assume that a strong historical payment record is sufficient for a Tier 1 rate.

This is a mistake. The "Hidden Friction Point" in 2026 is

Administrative Lag.

With the new "Property Portal" requirements, underwriters now perform real-time checks on a property’s compliance status. If there is a discrepancy between your mortgage application and the national database—even a minor clerical error regarding a gas safety certificate—the case is often auto-declined by algorithmic filters before a human even sees it.

Strategic Insight: The 2026 market punishes the "DIY Landlord." Specialist lenders now prefer "Institutional-Lite" borrowers: those who use professional management firms and digital compliance tracking. If your portfolio looks like a hobby, you will be priced like a risk.

At this stage, most successful borrowers involve a specialist like Willow Private Finance to sense-check the case before it reaches another credit committee.

Frequently Asked Questions

How does the abolition of Section 21 affect my HMO's valuation?

In 2026, valuations are increasingly "management-sensitive." While the "bricks and mortar" value may remain stable, the "Investment Value" (GDV based on yield) is being squeezed by the perceived difficulty of achieving vacant possession. RICS surveyors are now looking for evidence of "compliance-ready" properties. If your HMO requires significant work to meet the 2026 Decent Homes Standard, expect a "retention" on the valuation. Lenders are more comfortable with assets that have a clean digital footprint on the national Property Portal, as these represent lower "possession friction" should the lender ever need to step in.

Can I still get a 75% LTV mortgage on an HMO with periodic tenancies?

Yes, but the "entry requirements" have shifted. While 75% LTV remains the benchmark for the specialist market, the DSCR (Debt Service Coverage Ratio) is now the harder hurdle. With the 2026 Bank of England stance maintaining a "higher-for-longer" floor, and lenders adding a "periodic void buffer," your rental cover might need to be 145% or even 160% when tested at a notional 8% rate. We often help clients bridge this gap by utilizing "Top-Slicing"—using personal or business income to bolster the rental stress test.

What is the "Property Portal" and why does my lender care?

The 2026 Renters’ Rights Act introduced a mandatory digital database for all PRS properties. Underwriters now use this as a "Single Point of Truth." If your property is not registered, or if your landlord's "fit and proper" status is unverified, financing is effectively impossible. Lenders see the portal as a risk-mitigation tool; it ensures that the collateral they are lending against is legally compliant. Ensuring your data is pristine on the portal before an application is submitted is now a critical step in the financing process.

Are there still "Student HMO" exemptions in the 2026 Act?

There is a specific ground for possession for student accommodation, but it is narrower than many landlords expect. To qualify for the "Student Ground," the property must typically be let to students and intended for student use in the subsequent cycle. From a financing perspective, lenders are still happy to lend on student HMOs, but they are scrutinizing the "re-letting window." If you miss the narrow student cycle, the fact that you can no longer use Section 21 to "reset" the property for the next academic year is a risk they now price into the margin.

How should I structure my debt for an HMO conversion in 2026?

The "Bridge-to-Term" strategy remains king, but the "exit" is more complex. In 2026, you must prove the property meets all Renters’ Rights Act standards before the term lender will draw down. We are seeing a rise in "Hybrid Facilities" where the lender pre-approves the term exit based on a "Compliance Audit" at the start of the bridge. This eliminates the "exit risk" that has plagued many developers this year. Balancing Loan-to-Cost (LTC) during the build phase with a realistic post-reform yield is the key to maintaining your equity stack.

How Willow Can Help

Navigating the 2026 Renters’ Rights Act requires more than just a mortgage broker; it requires a debt architect who understands the interplay between legislative change and capital appetite. We maintain direct lines to the heads of credit at the UK's leading specialist banks, allowing us to present your HMO portfolio in a way that pre-empts the "periodic tenancy" concerns. We don't just submit applications; we build "Credit Proposals" that highlight your operational excellence and mitigate the perceived risks of the new legal landscape.

Our role is to solve the "Friction Point" of 2026: the gap between your property's actual performance and a lender's conservative "post-Act" model. By leveraging data from

UK Finance and the

ONS, we benchmark your portfolio against the wider market to ensure you aren't being unfairly penalized by outdated stress tests. Whether it’s moving from a bridge-to-term or restructuring a complex MUFB, we ensure your liquidity remains fluid even as the regulatory environment tightens.

The 2026 market belongs to the prepared. If you are holding an HMO portfolio and haven't reviewed your debt structures since the May 1st transition, you are likely overpaying for risk that can be mitigated. We invite you to a comprehensive portfolio review to ensure your financing is as resilient as your assets.

Important Notice

This article is provided for general information purposes only and does not constitute personal financial or mortgage advice. Mortgage suitability, affordability assessments, lender criteria, documentation requirements, and product availability depend on individual circumstances and may change at any time. Remortgaging decisions should take into account not only interest rates, but also regulatory requirements, income verification standards, and the risk of changes to personal or financial circumstances. You should always seek tailored, regulated advice before entering into, changing, or redeeming a mortgage. Willow Private Finance Ltd is authorised and regulated by the Financial Conduct Authority (FCA No. 588422). Registered in England and Wales.