Unlocking "Dry Powder" for 2026 property acquisitions without liquidating global portfolios.

As we navigate the fiscal complexities of 2026, High-Net-Worth Individuals (HNWIs) and professional investors are increasingly moving away from traditional, "siloed" financing.

The old model—liquidating high-performing equities to fund a property deposit—is being replaced by more sophisticated

Securities-Backed Lending (SBL) structures. In a year defined by both property market opportunities and equity market volatility, the ability to access "Dry Powder" without triggering Capital Gains Tax (CGT) or disrupting a long-term investment strategy is the ultimate competitive advantage.

According to latest analysis from

JLL, the velocity of the 2026 prime property market is rewarding those who can move with the speed of a cash buyer. SBL, often referred to as a "Lombard Loan," provides exactly that: a line of credit secured against your diversified investment portfolio. This allows for a "dual-engine" growth strategy where your equities continue to compound while your real estate holdings expand through the use of leveraged liquidity.

Lombard Facilities: The Non-Disposal Liquidity Route

The fundamental appeal of a Lombard facility in 2026 is the avoidance of "Opportunity Cost." In previous cycles, an investor wanting to buy a £2m asset might have sold £1m of stock. In 2026, with equity markets showing resilience despite the Bank of England's "higher-for-longer" interest rate stance, selling now means missing out on the recovery phase.

An SBL facility allows you to borrow against a percentage of your portfolio—typically ranging from 50% for volatile equities to 90% for high-grade bonds.

The "Strategic Analysis" here is the Tax-Alpha. By borrowing against the asset rather than selling it, you avoid a significant 2026 CGT event. Furthermore, because these facilities are often structured as revolving credit lines, you only pay interest on the capital you actually deploy into the property deal.

Lenders in 2026 are increasingly looking for "Holistic Wealth Management." At Willow, we connect our clients with private banks that view SBL as a gateway to a broader relationship, often resulting in margins that are significantly lower than standard bridging finance. For a professional landlord, this is the most efficient way to bridge the "Deposit Gap" in an environment where LTVs on specialist property remain conservative.

Cross-Collateralisation: Global Portfolios for UK Gains

The 2026 property market is seeing a surge in "Cross-Border Collateralisation." HNWIs with assets held in the US, EU, or UAE are finding that UK specialist lenders are becoming far more adept at underwriting global portfolios. This is a direct response to the

Financial Times reporting a trend of global capital seeking "safe haven" status in UK prime residential and HMO assets post-2026 legislative stabilization.

The

"Hidden Friction Point" in global SBL is

Jurisdictional Compliance. Many high-street private banks struggle to value an SPV held in a foreign jurisdiction against a UK property purchase. This is where the "Relatable Specialist" approach becomes vital. We navigate the friction by identifying lenders who utilize "Universal Custody Agreements."

By cross-collateralising a global equity portfolio, an investor can often achieve 100% financing for a UK property acquisition. The equity portfolio acts as the "top-up" security, eliminating the need for a cash deposit entirely. In 2026, this "Zero-Cash Entry" strategy is the hallmark of the most aggressive and successful portfolio builders.

Margin Call Mitigation in Volatile 2026 Markets

The primary risk of any SBL facility is the dreaded "Margin Call." If your equity portfolio drops in value, the lender may demand additional collateral or a partial repayment of the loan to maintain the agreed Loan-to-Value (LTV). In the volatile markets of early 2026, managing this risk is paramount to protecting your property stack.

Underwriters in 2026 are now performing "Stress-Correlative Audits." They aren't just looking at your portfolio's current value; they are looking at how it correlates with the property market. If your equities are heavily weighted in property-tech or REITs, a lender will view the risk as "doubled up."

To mitigate this, we advise clients on

"Collateral Diversification." By ensuring the SBL is backed by a mix of uncorrelated assets—such as blue-chip equities, sovereign debt, and even certain high-value commodities—we can negotiate wider "Covenant Buffers." In 2026, a 10-15% "Headroom" in your LTV can be the difference between a smooth acquisition and a forced liquidation during a market dip.

Arbitrage: SBL Rates vs. Prime Property Yields

The most technical aspect of the 2026 SBL market is the "Yield Arbitrage." With SBL rates often tracking closer to the base rate than traditional property debt, there is a window for professional investors to borrow at 4.5% against their stocks to buy an HMO asset yielding 7.5% or more.

According to

UK Finance, the "Net Interest Margin" is the primary driver of wealth in 2026. If the cost of the SBL debt is lower than the net yield of the property, the "Excess Yield" can be used to pay down the equity loan or reinvested into further equity positions. This creates a "Virtuous Cycle" of wealth creation.

However, the "Friction Point" here is

Debt Servicing Perception. Traditional property underwriters may see an SBL loan as a personal liability that impacts your affordability for the main mortgage. We solve this by ensuring the SBL is treated as "Corporate Liquidity" within an SPV or FIC structure, keeping your personal debt-to-income ratios clean and maintaining your eligibility for the best Tier 1 mortgage rates.

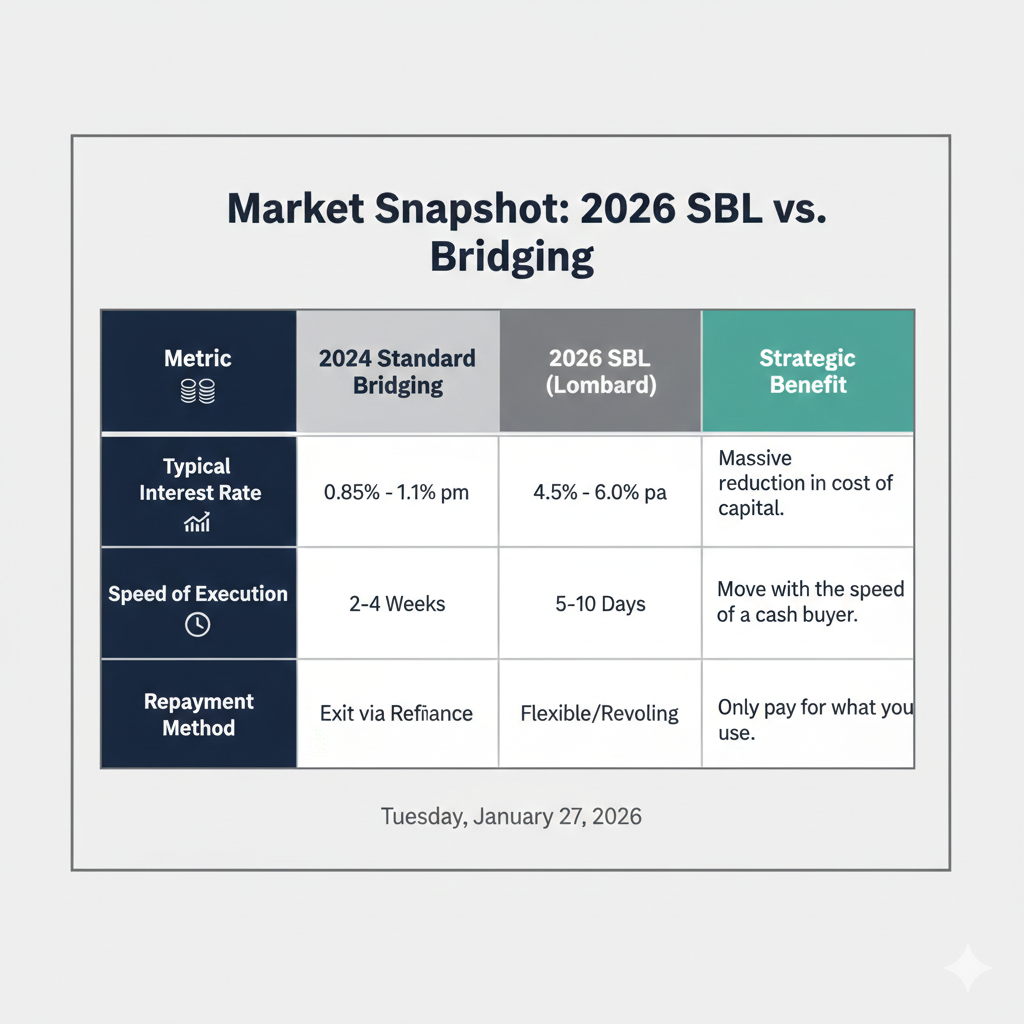

Market Snapshot: 2026 SBL vs. Bridging

Where Most Borrowers Inadvertently Go Wrong in 2026

In the current climate, many HNWIs approach their existing retail bank for an SBL facility. This is the "Hidden Friction Point." Retail banks often have rigid "concentration limits" and will only lend against a very narrow list of "approved" funds. If your wealth is tied up in a bespoke portfolio or a private family office structure, the retail bank will often say no, or offer a prohibitively low LTV.

Strategic Insight: SBL is a specialist product that requires a specialist lender. In 2026, "Asset-Rich but Liquidity-Poor" is a choice, not a condition. The mistake is assuming that because your bank holds your assets, they are the best people to lend against them.

At this stage, most successful borrowers involve a specialist like Willow Private Finance to sense-check the case before it reaches another credit committee.

Frequently Asked Questions

What exactly is Securities-Backed Lending (SBL)?

SBL is a loan or credit line secured against a portfolio of marketable securities, such as equities, bonds, or investment funds. In 2026, it is used by HNWIs to unlock liquidity for property purchases without having to sell their investments. This maintains their market exposure and prevents a Capital Gains Tax (CGT) event, effectively acting as a low-cost, flexible alternative to a traditional bridge or deposit.

How does a "Margin Call" work in the 2026 market?

A margin call occurs if the value of your pledged securities falls below a certain threshold (the "Maintenance LTV"). In 2026's volatile markets, if this happens, the lender will ask you to either provide more securities, pay down some of the loan, or sell part of the portfolio to cover the gap. We mitigate this for Willow clients by negotiating "Covenant Buffers" and ensuring the initial LTV is set at a defensive level.

Can I use SBL for 100% of a property purchase?

Potentially, yes. If your investment portfolio is large enough, the SBL facility can provide the 25% deposit while a standard mortgage provides the 75%. In some cases, if the SBL facility itself can cover the full purchase price, you can act as a cash buyer. This "Cross-Collateralisation" strategy is highly popular in 2026 for HNWIs looking to move quickly on prime assets.

Is SBL more expensive than a standard mortgage?

Actually, SBL rates are often significantly lower than specialist property debt. Because the collateral (liquid equities) is more easily "sold" by a lender than a house, the risk is lower. In 2026, SBL rates often track at a small margin over the Bank of England base rate, making it one of the most cost-effective ways to access capital.

Can I still trade my stocks while they are pledged for an SBL loan?

Yes, in most "Lombard" style facilities, you retain the ability to manage your portfolio, buy and sell holdings, and collect dividends. The only restriction is that you cannot withdraw the capital below the agreed LTV limit. This allows your wealth strategy to continue uninterrupted while you use the borrowed liquidity for your property acquisitions.

Does SBL work for expat property investors in 2026?

SBL is an ideal tool for expats. As we explore in our guide on

Expat Mortgages 2026, proving foreign income can be difficult. However, an SBL facility is based on the assets you hold, not just your monthly salary. This provides a much smoother path to UK property acquisition for those living in jurisdictions like Dubai or Singapore.

How Willow Can Help

Willow Private Finance specializes in the architecture of complex, multi-asset debt. We understand that your wealth is not just a balance sheet, but a strategic tool for growth. Our access to boutique private banks and specialist SBL providers allows us to source facilities that are truly flexible—recognizing global assets, complex shareholding structures, and diverse investment portfolios.

We solve the "Friction Point" of 2026 by acting as the bridge between your investment manager and your property ambitions. We ensure that the SBL facility is structured to complement your long-term property strategy, providing the "Dry Powder" you need to strike when the right HMO, commercial, or prime residential asset appears.

The 2026 market belongs to those who can move fast without breaking their long-term wealth strategy. Whether you're looking to incorporate a portfolio as discussed in our guide on

Incorporating a Property Portfolio in 2025: Lending, Tax & Timing Considerations or looking to fund a development as outlined in

Development Exit Finance in 2025: Bridging the Gap from Build to Sale, SBL is the fuel for your growth. Contact us today for a confidential review of your global asset position.

Important Notice

This article is provided for general information purposes only and does not constitute personal financial or mortgage advice. Mortgage suitability, affordability assessments, lender criteria, documentation requirements, and product availability depend on individual circumstances and may change at any time. Remortgaging decisions should take into account not only interest rates, but also regulatory requirements, income verification standards, and the risk of changes to personal or financial circumstances. You should always seek tailored, regulated advice before entering into, changing, or redeeming a mortgage. Willow Private Finance Ltd is authorised and regulated by the Financial Conduct Authority (FCA No. 588422). Registered in England and Wales.